Life & Health Insurance Reports

Use the 4% Rule to Secure Your Financial Future

Visions of a fulfilling retirement often include travel, leisurely pursuits, and quality time with loved ones.

Read MoreBenefits of Hospital Indemnity Insurance

Hospital indemnity insurance is gaining in popularity as a way to deal with increasingly higher out-of-pocket expenses. It’s not health insurance, but it provides a cash benefit you can use to pay for expenses health insurance doesn’t cover. The Centers for Disease Control and Prevention estimated that the average hospital stay in 2017 was five…

Read MoreRetirees Should Check Their Medicare Coverage Before Traveling

If you have Medicare and plan to travel, it’s essential to check your coverage for potential gaps that could lead to expensive bills.

Read MoreIs No-Exam Life Insurance Right for You?

Getting life insurance can be complicated and time-consuming. But not always.

Read MoreNever Outlive Your Savings with Longevity Annuities

The Centers for Disease Control and Prevention estimates that the average 65-year-old will live at least another 20 years, which is six years more than what life expectancy was in 1950. While this is great news, it does present a financial challenge – how to ensure that your retirement savings will last a lifetime. Some…

Read MoreShould You Use Your Credit Card to Pay Your Medical Insurance Premiums?

Tempted to pay for your medical expenses and health insurance premiums with a credit card? There are pros and cons. Even though health insurance companies and providers are not required to accept credit cards, many do. Is it a good idea though? Here are the pros and cons: Pros Using a credit card…

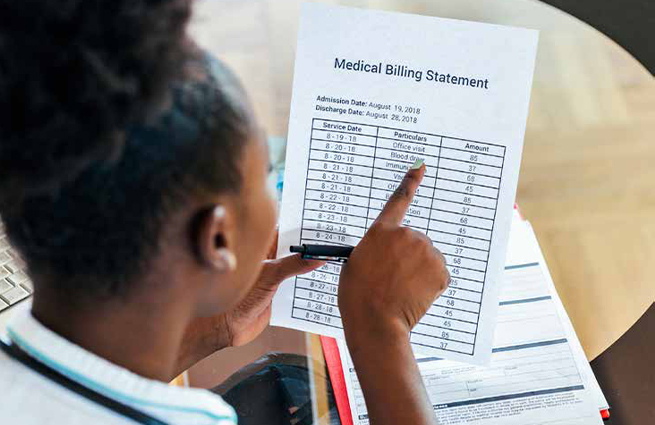

Read MoreCongress Takes the Surprise Out of Surprise Billings

Consumers can look forward to January 2022 as an end to unexpected — or “surprise” — medical bills. Congress passed a bill in December to stop this practice. Surprise medical bills, also referred to as balance billing, occur when patients are billed for care received from out-of-network providers where insurance covers none or only a…

Read MoreYour Life Insurance Options During the COVID-19 Pandemic

With the news media reporting daily on the number of COVID-19 cases and deaths, it’s not surprising that many people are concerned about whether their families will be taken care of if they contract the disease and die. Defer Now, Pay Later If you took advantage of President Trump’s executive order allowing you to not…

Read MoreYour Options if You Lose Your Employer- Sponsored Health Care Coverage

Estimates are that more than 26 million people could become uninsured due to the workplace shutdowns. The Economic Policy Institute estimates that because of the COVID- 19 virus and workplace shutdowns, 16.2 million American workers have lost their employer-sponsored health care coverage since mid-March. The Kaiser Family Foundation estimates that 26.8 million people in the…

Read MoreWhat the Coronavirus Taught Us

Wash your hands and check your healthcare benefits to see what’s covered! Because of the COVID-19 coronavirus pandemic we’ve learned a new term — social distancing — and relearned the importance of thoroughly washing our hands. We’ve also learned the importance of understanding what tests, procedures and care are covered by our health insurance. In…

Read More